The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

It might seem odd to have such 100 SPX points rally with 4/2 “Tariff Liberation Day” looming, but it is not abnormal to have big days right after March OpEx /Triple Witching with large positioning reset. If one remembers, COVID low in 2020 was the Monday noon (3/23/2020) after March 2020 Triple Witching Friday. Few trust this rally and I am one of them - unless SPX convincingly goes above 5800. Tesla will be the most important stock to watch as to where the market goes next.

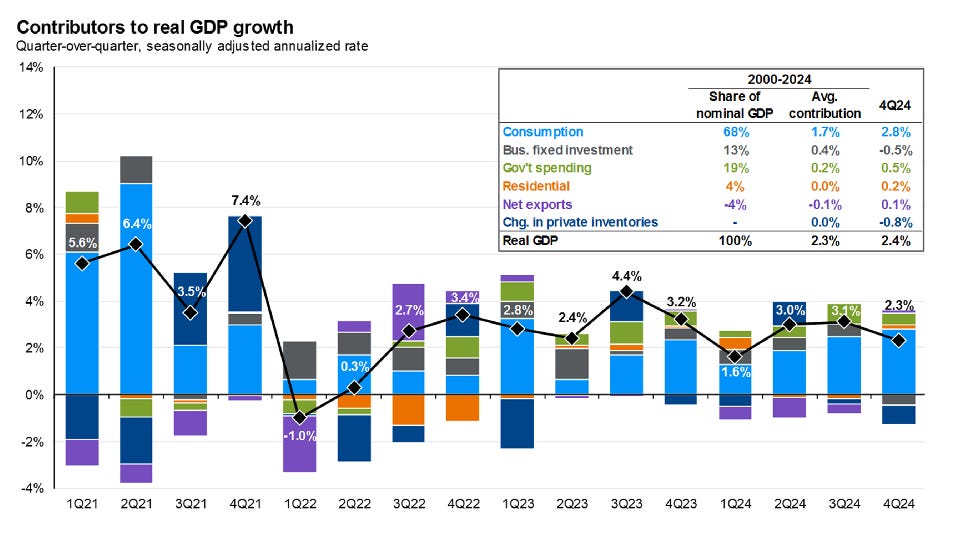

Too much noise around DOGE cut in DC. I am a big believer of Daoist Doctrine, things always work to the contrary when going to extremes (物极必反). Biden Adminstration is one extreme, Trump is the other. As govt spending is 20% of GDP and more importantly the money supply/liquidity it creates to circulate through the economy, there is not going to have an economy left with deep cuts, and Musk should not touch Social Security as it is the backbone of US economy. US govt will have to print and blow up the deficit even more if we dip into deep recession. At the end of the day, debt fuels growth - for however long it helps. My bet is the cutting effort will eventually be pushed back. I am overall bullish on US MidCap for the time being.

https://x.com/SecScottBessent/status/1901368163440140410

Some thoughts on this Bessent comment that he wants to de-leverage the govt and to re-lever the private sector. The main reason why US exceptionalism exists in last 15 years is: US govts basically transfers credit risk from private sector to govt balance sheet through the Fed and various bailout packages/stimulus, so deleveraging public sector just so to re-lever private sector will take credit risk back to financial system again, which seems ominous to me long term.

Important charts I am monitoring:

this table means 5300 is a good buy if it gets there.

Keep reading with a 7-day free trial

Subscribe to SuperZen Macro Blog to keep reading this post and get 7 days of free access to the full post archives.