Macro Week Ahead 7/29

Summary

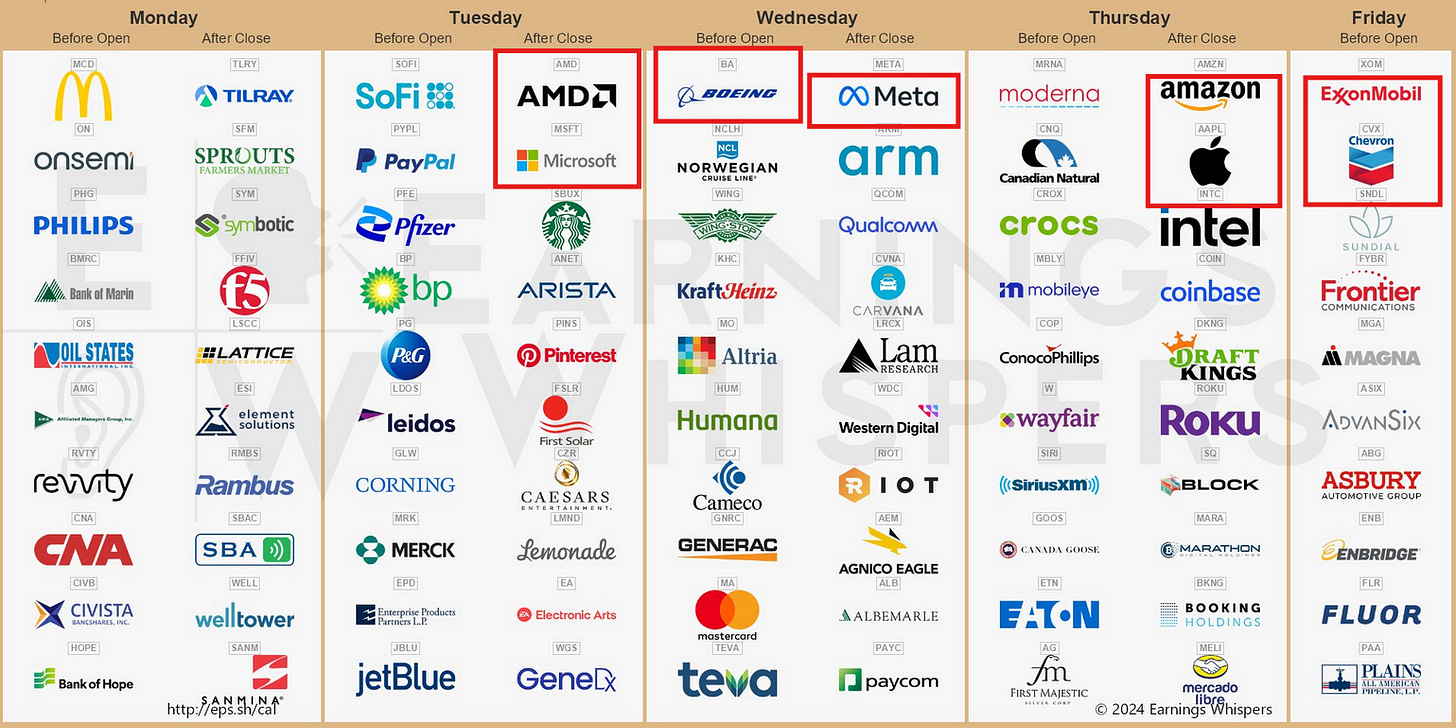

The week ahead may best be described as the make or break week of the summer, filled with very busy schedules from Central Banks policy meetings (the Federal Reserve on Wednesday, Bank of Japan and Bank of England on Thursday), Big Tech Earnings ( AMD, MSFT, META, AAPL, AMZN) and economic data releases with special focus on US jobs (Thursday and Friday) and EU PMIs. And one not to be ignored - the month end rebalancing. I will slice and dice each theme below:

Major Themes

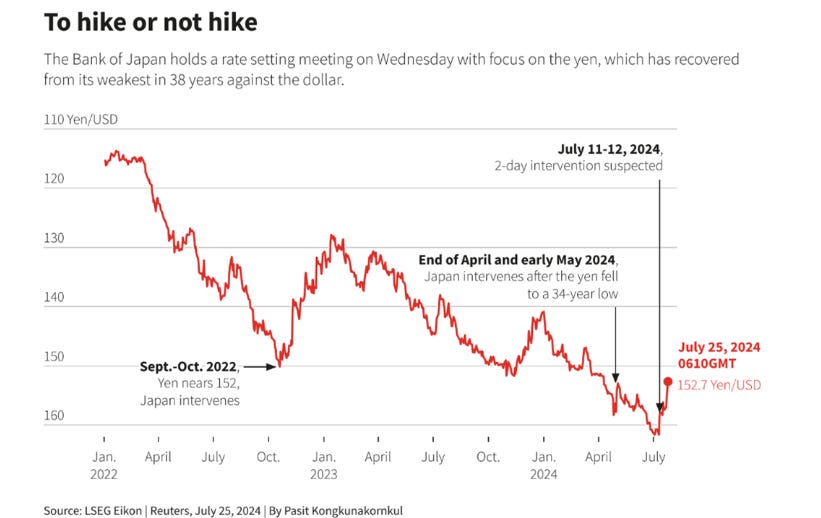

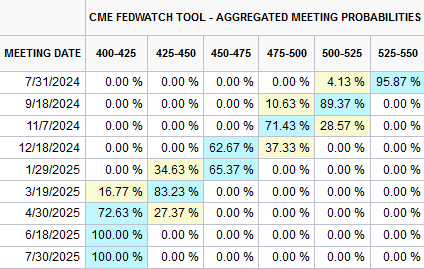

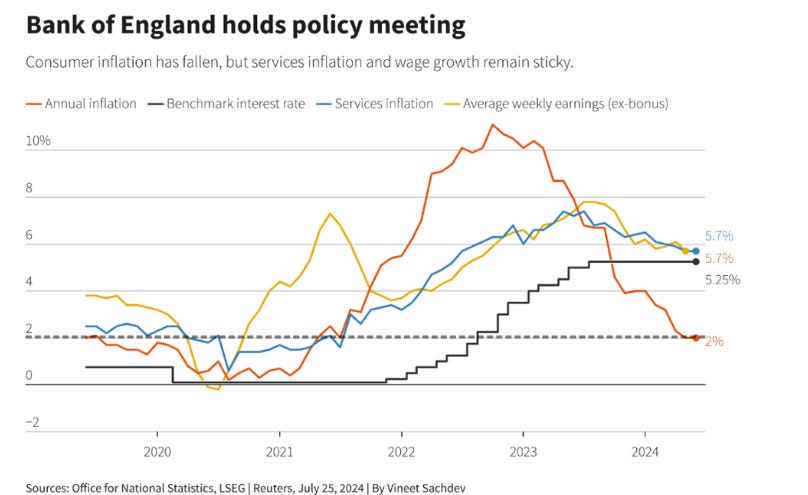

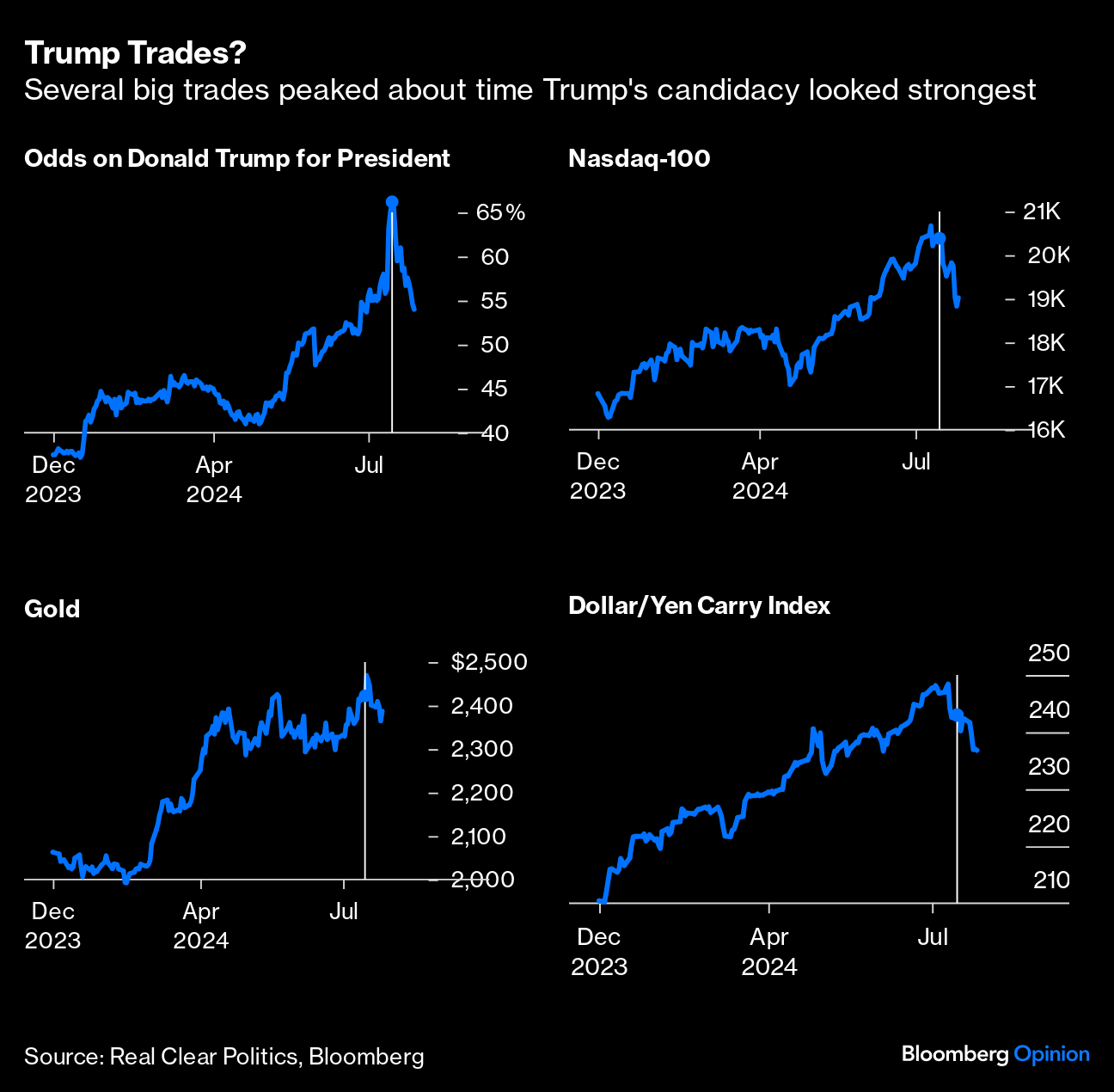

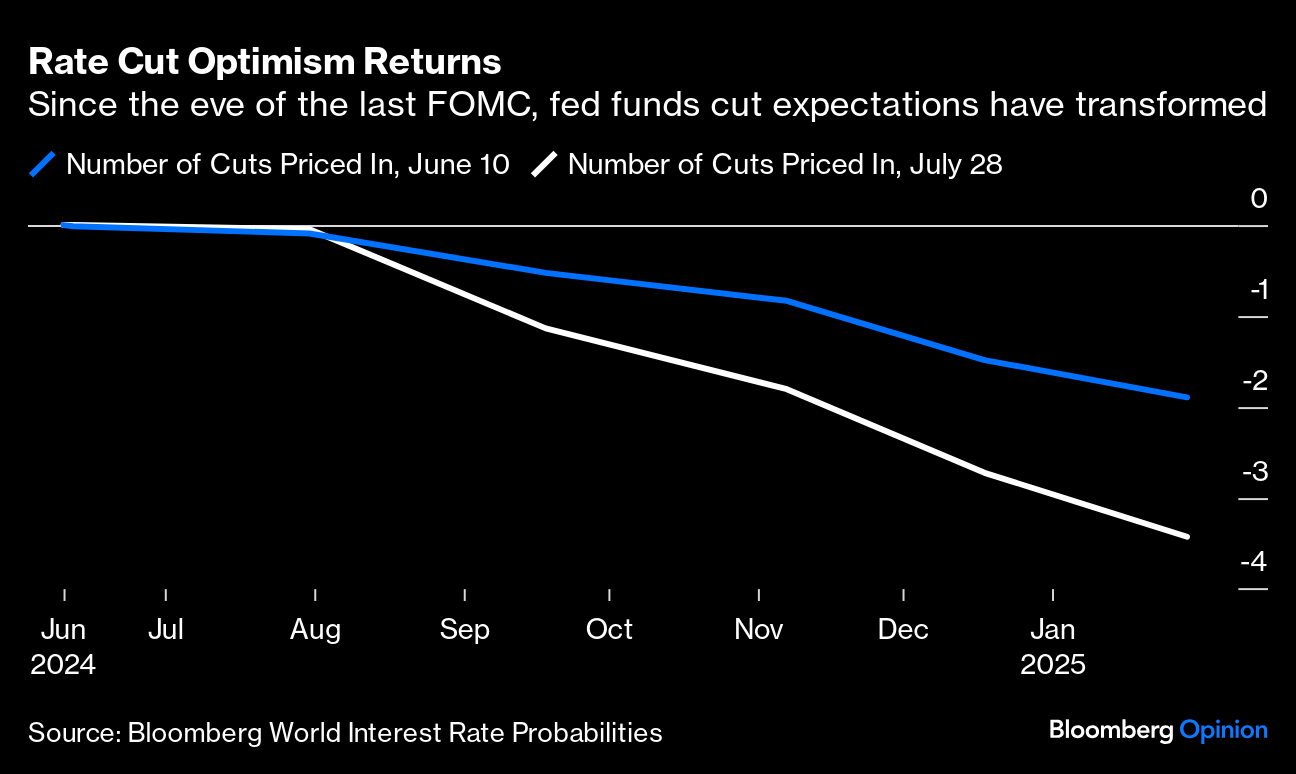

FOMC and BOJ Divergence - There is no question that a serious deleveraging is going on in Japan. The risk of USDJPY breaking below 150 and moving south towards 52 week low (or high) at 140 zone has implications across the markets with bonds and US Dollar in focus. BOJ hiking while FOMC guiding toward easing makes it very interesting. It is very murky right now as to how all dynamics are working against each other on this chess board. I will wait and take actions once the sky is much more clear. Being an observer and you know what they say: patience is a virtue… For the Fed, I expect Powell will wait until Jackson Hole speech to spell out the plan for any easing with a focus on the neutral rate and path ahead. The wild card is how 2Y/10Y yields are going to move, as short end 2Y will follow the path of monetary policy and long end 10Y reflects fiscal concerns.

and a warp speed of 20 points SPX future drop right at 7PM EST mark tells the power of JPY ( 7 p.m. to 4 a.m EST is the active overnight session in Tokyo).

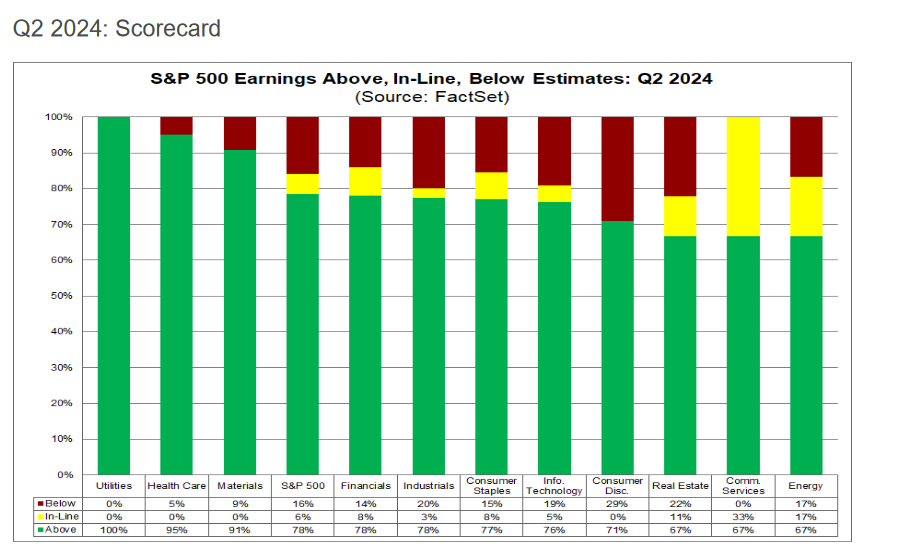

Slew of Q2 Earnings and Continuation of Rotation Trade - Earnings scorecard according to Factset: For Q2 2024 (with 41% of S&P 500 companies reporting actual results), 78% of S&P 500 companies have reported a positive EPS surprise, which is below the 1-year average, below the 5-year average and below the 10-year average. Disappointing numbers could be devastating for bulls and trigger selloff similar to the one on 7/24/2024.

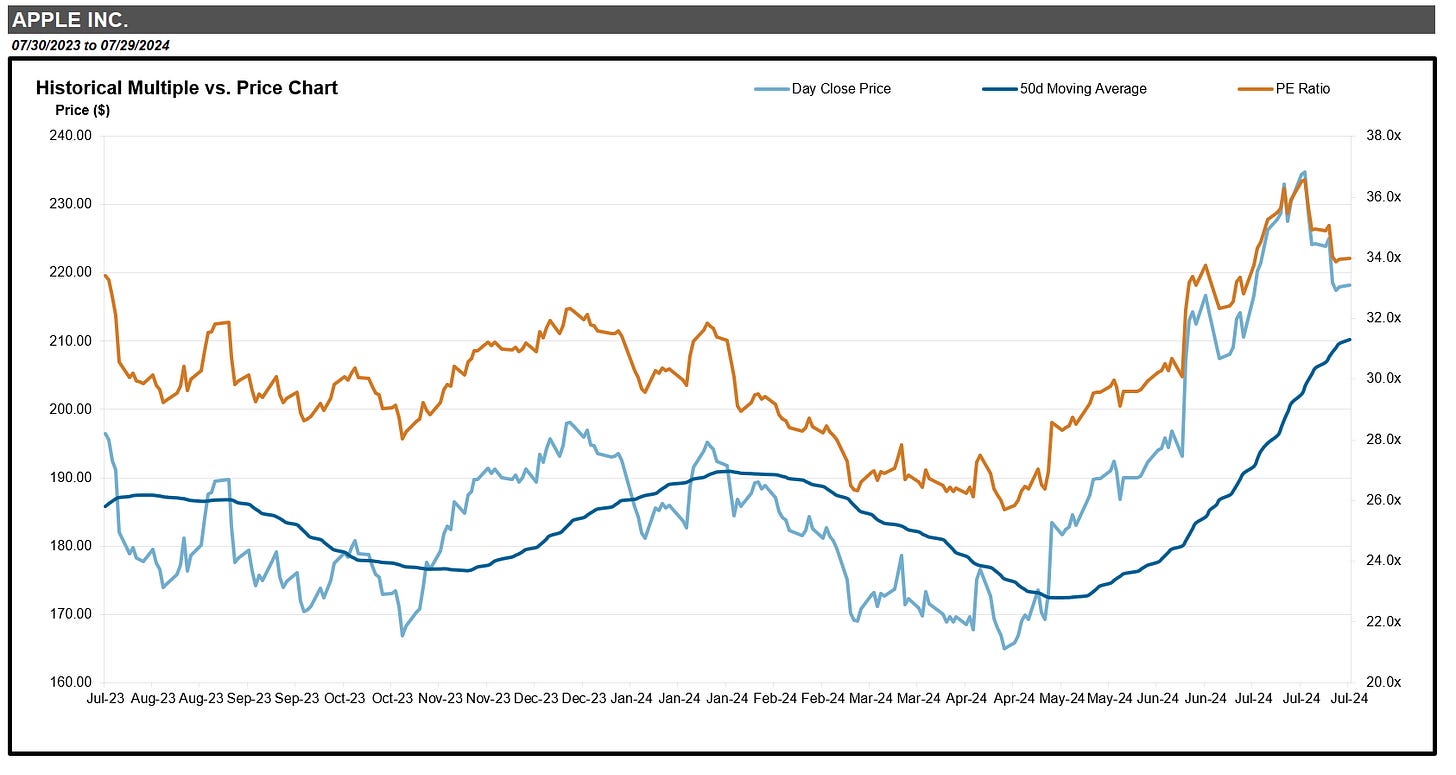

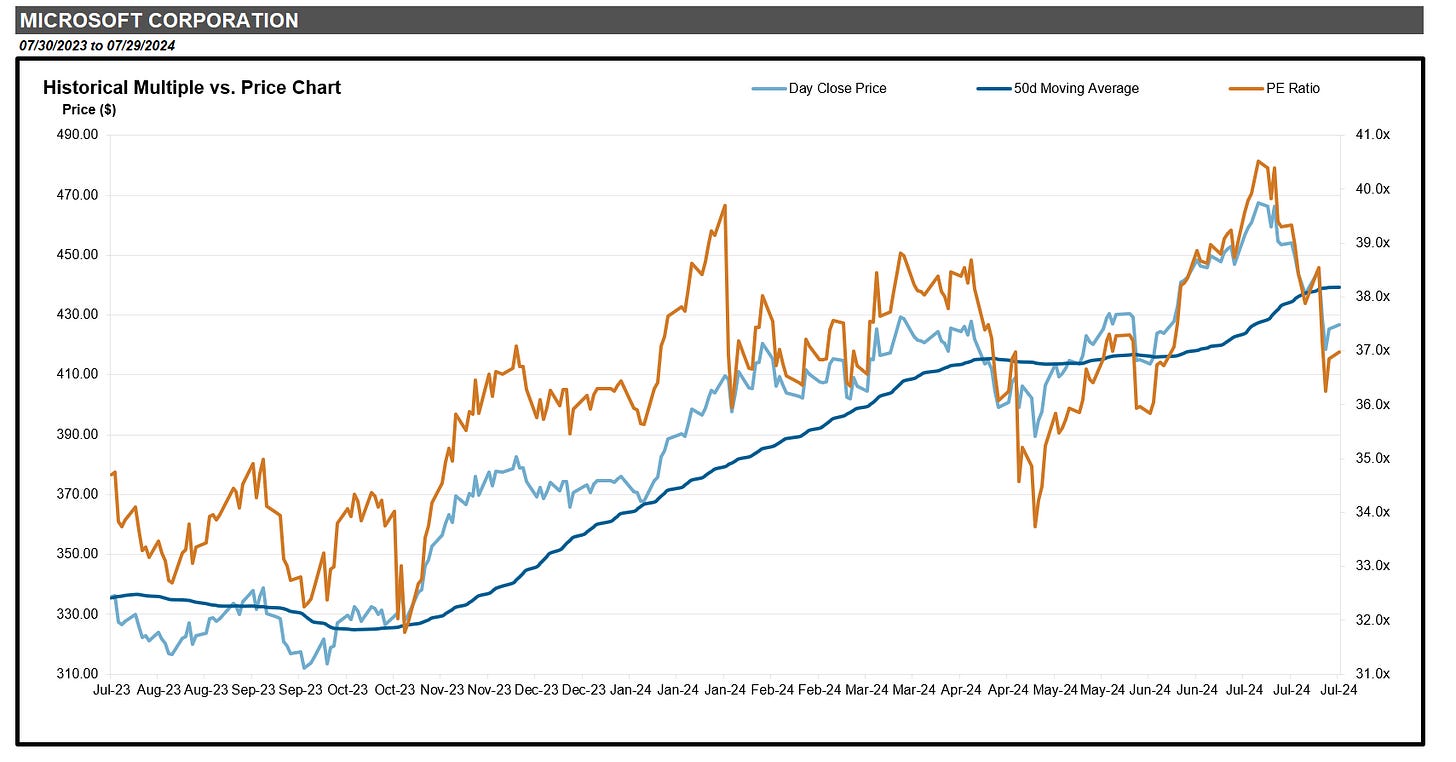

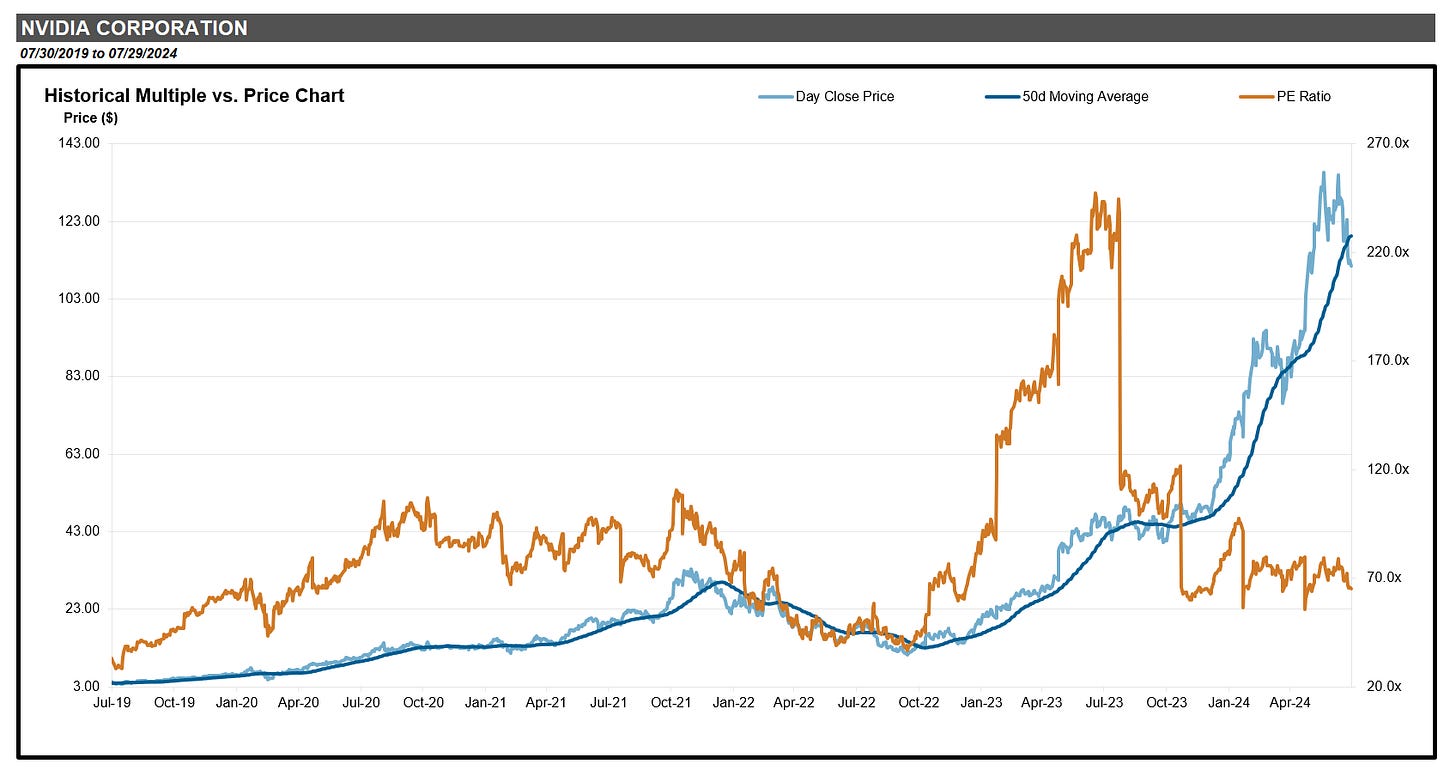

Running 1-year historical multiples look back for top two names: Apple and Microsoft. PEs are still very elevated, albeit coming off highs. For next 3 months, considering summer volatility, at best QQQ drifts flattish IMHO. Nvidia will not report until 8/28/2024. Interestingly, a 5-year look back saw PE coming off sky high levels: does lower PE mean lower growth?

The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

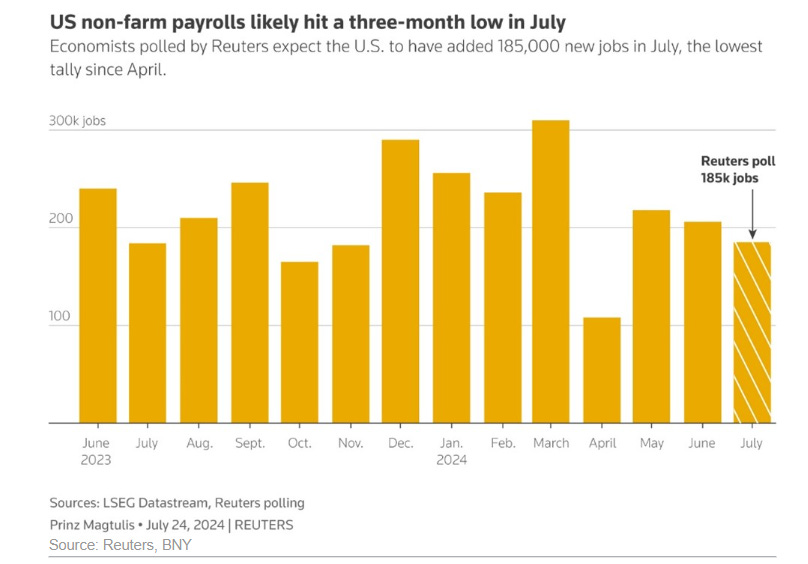

US Jobs and FOMC Easing Hopes - July 31 is perhaps the biggest day of the week, FOMC meeting/ month end rebalancing/ Treasury Funding Announcement ( last note). Economists polled by Reuters expect the U.S. to have created 185,000 jobs in July, compared with 206,000 in the prior month. My contrarian call would be a number above will drive a rally and ease the slowdown concern.

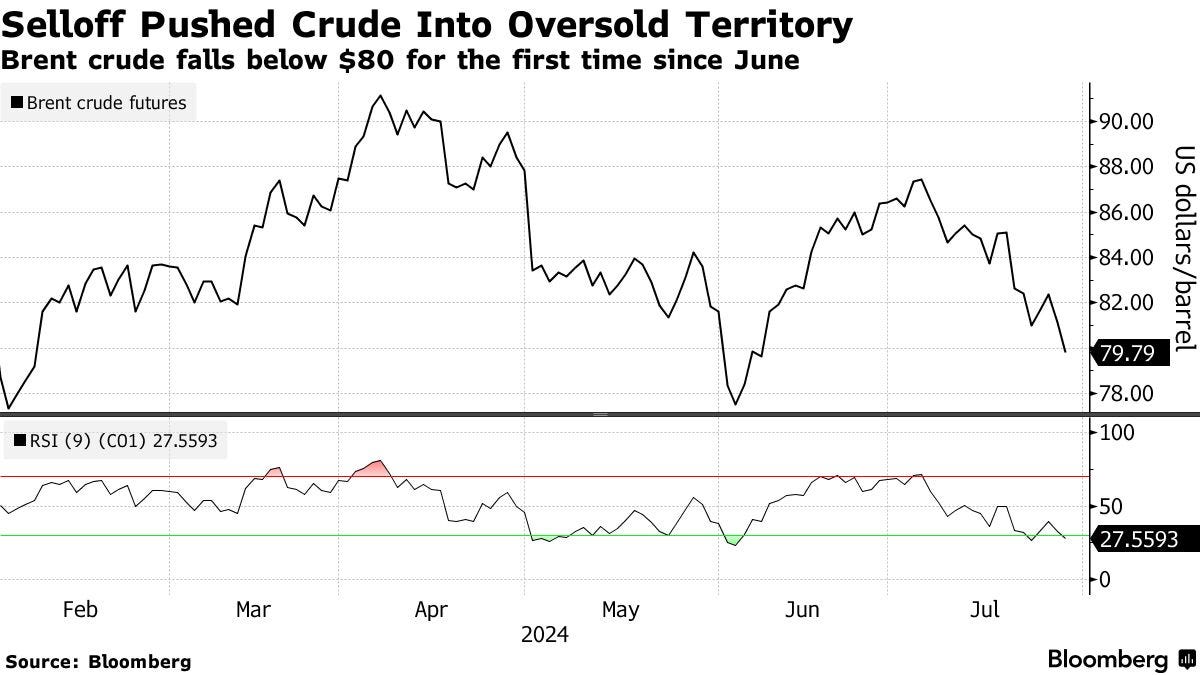

and Last but Not Least: what is going on in Oil Market?

Charts I am watching:

The genesis of starting this blog and my value proposition is to share my approach to interpreting data and the tea leaves that others might overlook. I put in a lot of time and effort into writing this, and open to suggestion for enhancement. If you like this type of content, then consider subscribing and sharing to support my work. This means a lot and motivates me continue to post ideas.

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, and bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Furthermore, you will not share or copy any content in this blog as it is the authors’ IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal.